Sparse secondary trading and the long holiday weekend allowed municipals to outperform U.S. Treasuries and corporates Friday as the dearth of primary issuance has kept investors engaged without demanding as much concession despite volatility.

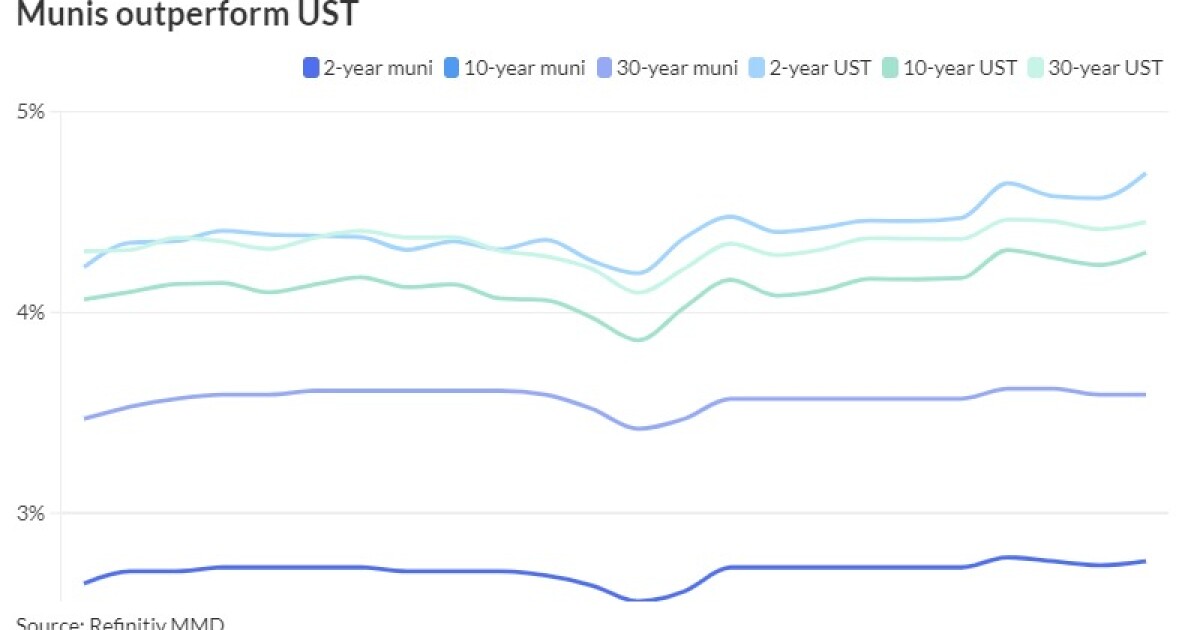

Triple-A yields were slightly cheaper on the short end while UST yields rose up to nine basis points on the short end but saw losses along the curve.

“Friday’s above-consensus PPI for January provided a weaker tone [in USTs] just ahead of the three-day holiday weekend, and time will tell just how far the weakness will extend,” noted Jeff Lipton, head of municipal research and market strategy at Oppenheimer & Co.

Municipals, with continued supportive technicals and available sidelined cash, has “runway to outperform on market weakness,” he said.

Even though USTs remain “quite volatile,” with yields moving up another three to nine basis points Friday after five to seven basis point increases throughout the week, “our market remains quite solid, with ratios trending sideways for the most part,” noted Barclays PLC in a weekly report. “However, poor Treasury performance has leaked into muni performance, with both IG and HY index total returns in the red this year.”

Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said the AAA part of the muni investment grade index has underperformed, “partially due to its slightly longer duration as well as better liquidity, making it easier to sell if needed,” while, lower-rated credits have done better, “especially solid single-As, and credit spreads have continued to compress.

“Muni market valuations are being driven by technical dislocations that may not normalize so quickly, and in the absence of any significant credit event, muni spreads can be expected to stay range-bound,” Lipton said.

Barclays said they were still “somewhat concerned” about rates and high-grade valuations are still rich.

The two-year muni-to-Treasury ratio Friday was at 60%, the three-year at 59%, the five-year at 58%, the 10-year at 58% and the 30-year at 81%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 60%, the three-year at 59%, the five-year at 58%, the 10-year at 58% and the 30-year at 80% at 3:30 p.m.

“Hence, we would remain on the sidelines, as many other investors are doing at the moment,” Barclays strategists said. “However, with supply still low, and fund outflows just marginal, it is not clear what would substantially cheapen the market, and we could get stuck in the current range for some time.”

Part of the strength has been due to the lack of larger new-issue supply, both this week and the expected $4.56 billion for the holiday-shortened week.

“New-issue activity saw good reception on the week and secondary business caught a respectable bid as cash pursued opportunistic deployment,” Lipton said.

Leading the calendar for the coming week is $659 million of triple-A Princeton University revenue bonds to be issued by the New Jersey Educational Facilities Authority Wednesday along with several housing deals. Nevada leads the competitive calendar with $134 million of highway revenue bonds Thursday.

Bond Buyer 30-day visible supply sits at $8.46 billion.

“Should rate volatility subside, a net negative supply of $14.2 billion per Bloomberg over the next 30 days should be accretive to muni returns given heavy reinvestment needs, but we must be mindful that we are quickly approaching the April 15 tax filing deadline, a time normally associated with more active muni selling to cover new tax liabilities,” Lipton said.

Barclays expects more issuance in March, “which could also coincide with tax-related selling, and lower bond redemptions.”

“We believe that is quite possibly when the market could actually correct higher,” they said.

Muni CUSIP requests fall

Municipal CUSIP request volume fell in January on a year-over-year basis, following a decrease in December, according to CUSIP Global Services.

For municipal bonds specifically, there was a drop of 3.3% month-over-month and a drop of 2.2% year-over-year.

The aggregate total of identifier requests for new municipal securities — including municipal bonds, long-term and short-term notes, and commercial paper — fell 2.2% versus December totals. On a year-over-year basis, overall municipal volumes are up 1.0%. Texas led state-level municipal request volume with a total of 79 new CUSIP requests in January, followed by California (58) and Massachusetts (44).

Negotiated calendar:

The New Jersey Educational Facilities Authority (Aaa/AAA//) is set to price Wednesday $659.060 million of Princeton University revenue bonds, consisting of $500 million of new-issue bonds, 2024 Series B, and $159.060 million of refunding bonds, 2024 Series C. Goldman Sachs.

The Maryland Transportation Authority (Aa2//AA/) is set to price Thursday $628.325 million of tax-exempt transportation facilities projects revenue refunding bonds, Series 2024A. BofA Securities.

The Michigan State Housing Development Authority (Aa2/AA+//) is set to price Thursday $374.675 million of social single-family mortgage revenue bonds, consisting of $248.350 million of non-AMT bonds, 2024 Series A, serials 2024-2036, terms 2039, 2044, 2049, 2053, 2054; and $126.325 million of taxables, serials 2024-2034, terms 2039, 2044, 2050. Barclays Capital.

The California Infrastructure and Economic Development Bank (A2///) is set to price Thursday $281.450 million of California Academy of Sciences sustainability revenue bonds, consisting $140.725 million of Series 2024A and $140.725 million of Series 2024B. Wells Fargo.

The Connecticut Housing Finance Authority (Aaa/AAA//) is set to price Wednesday $196.885 million of social Housing Mortgage Finance Program bonds, 2024 Series A, serials 2024-2036, terms 2039, 2044, 2049, 2051, 2054. BofA Securities.

The Virginia Housing Development Authority (Aa1/AA+//) is set to price Thursday $177.070 million of non-AMT rental housing bonds, 2024 Series A, serials 2026-2036, terms 2039, 2044, 2049, 2054, 2059, 2065. BofA Securities.

The Wisconsin Health and Educational Facilities Authority (Baa2///) is set to price Wednesday $163.720 million of Forensic Science and Protective Medicine Collaboration Project revenue bonds, Series 2024, serial 2027. Raymond James.

The Creek County Educational Facilities Authority, Oklahoma, (/AA//) is set to price Thursday $153.840 million of BAM-insured Sapulpa Public Schools Project educational facilities lease revenue bonds, Series 2024. D.A. Davidson.

The North Dakota Housing Finance Agency (Aa1///) is set to price Wednesday $149 million of social non-AMT Home Mortgage Finance Program housing finance program bonds, serials 2025-2036, terms 2039, 2044, 2049, 2052, 2054. RBC Capital Markets.

The State of New York Mortgage Agency (Aa1///) is set to price Thursday $139.120 million of social homeowner mortgage revenue bonds, consisting of $72.765 million of non-AMT bonds, Series 258, serial 2039, terms 2044, 2049, 2054; $72.765 million of AMT bonds, Series 259, serials 2024-2036, term 2039; and $39.120 million of taxables, Series 260, serials 2024-2036, terms 2039, 2043, 2054. BofA Securities.

The Virginia College Building Authority (Aa1/AA+//) is set to price Thursday $101.900 million of University of Richmond educational facilities revenue and refunding bonds, Series 2024, serials 2027-2034, 2036, 2038-2044, terms 2049, 2054. BofA Securities.

Competitive calendar:

The East Central Independent School District, Texas, (Aaa///) is set to sell $100 million of PSF-insured unlimited tax school building bonds, Series 2024, at 11:30 a.m. eastern Thursday.

Nevada is set to sell $89.620 million of motor vehicle fuel tax highway improvement revenue bonds, Series 2024A, at 11:15 a.m. Thursday, and $45.080 million of indexed tax and subordinate motor vehicle fuel tax highway improvement revenue bonds, Series 2024B, at 11:45 a.m. Thursday.