Municipals were firmer Friday ahead of a large new-issue calendar, which boasts billion-dollar-plus deals from Pennsylvania and the New York City Transitional Finance Authority along with a sizable taxable Hawaii general obligation bond deal. U.S. Treasuries were rallying and equities were up near the close.

Triple-A yields fell up to six basis points, depending on the curve, while USTs saw gains of 13 to 17 basis points.

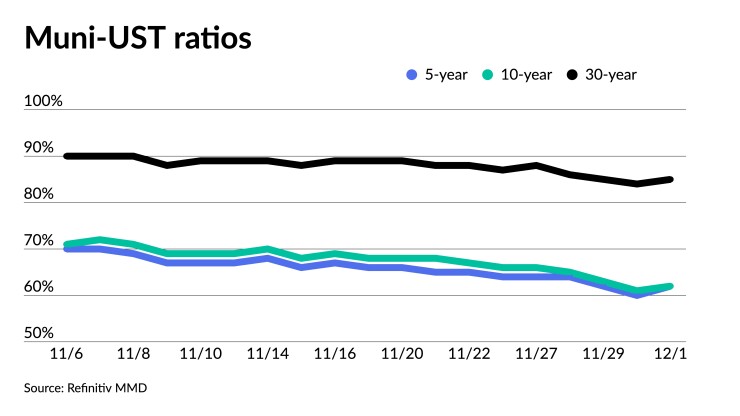

The two-year muni-to-Treasury ratio Friday was at 62%, the three-year at 62%, the five-year at 62%, the 10-year at 62% and the 30-year at 85%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 60%, the three-year at 60%, the five-year at 59%, the 10-year at 61% and the 30-year at 83% at 4 p.m.

The new-issue muni calendar is estimated at $9.379 billion next week with $6.198 billion of negotiated deals on tap and $3.181 billion on the competitive calendar, according to Ipreo and The Bond Buyer.

Pennsylvania leads the new-issue calendar with $2.1 billion of GOs in four series via the competitive market.

Pennsylvania last sold GOs in September 2020 with 5s of 5/2023 at 0.25% (+11/BVAL), 5s of 2028 at 0.85% (+28/BVAL), 4s of 2033 at 1.50% (+49/BVAL) and 3s of 2038 at 2.00% (+73/BVAL).

Other large deals for next week include the New York City Transitional Finance Authority with $1.4 billion of future tax-secured subordinate bonds in both the negotiated and competitive market, the Garland Independent School District, Texas, with $774 billion of unlimited tax school building bonds in the negotiated market, and Hawaii with $750 million of GOs in the negotiated market.

November performance best in three decades, but choppiness may be ahead

This year has “turned out to be quite difficult for municipals, which have been negatively affected by rate volatility for most of the year, with index returns jumping up and down,” Barclays strategists said.

Munis “performed well in the early part of the year, as the 2022 year-end rally continued until mid-February,” they noted.

Through the first half of the year, tax-exempts were “on track for a solid year,” but after an “extremely difficult” August and October, munis gave up all their gains for the year, they said.

“And only the ‘annual’ year-end rally was able to pull returns back into positive territory,” Barclays strategists said.

For this year, though, index returns should still be positive, they said.

The broad Bloomberg municipal index returned 6.35% for November, the highest returns in three decades.

The high-yield index returned 7.75%, and taxables posted returns of 4.95%. After November’s gains, year-to-date, munis are returning 3.98%, high-yield 6.03% and taxables 3.70%.

Barclays strategists believe the year-end rally “will likely continue through at least December, and see currently unattractive muni valuations possibly getting even richer by the end of the year.”

Barclays noted that in its 2023 outlook, the strategists expected “mid-single-digit returns” for the asset class for all of 2023.

“Unless December follows November strength, we will likely end up slightly below that mark, although index returns for the year should still be positive, illustrating yet again that muni returns rarely stay in negative territory for two years in a row — for IG it has happened only once, more than 40 years ago; and for HY only during the financial crisis,” they said.

However, the road ahead will most likely be “choppy,” they noted.

In 2024, Barclays strategists “expect the relative strength of the municipal market to continue through early January, but the path is data-dependent,” they said.

They expect “an economic slowdown, but not a recession, which should result in just marginally lower Treasury yields by the end of the year, which should help generate solid returns for municipals, but mostly driven by carry.”

If USTs move higher in the first quarter of 2024, they said “tax-exempts would not be immune; we will likely see heavier-than-expected supply early next year.”

Consequently, Barclays strategists expect “a challenging start to the year, although the market will likely regain its footing by late spring-early summer.”

Munis “will likely generate solid, although not spectacular total returns, mostly driven by coupon income, in addition to marginal excess returns, mostly generated by spread compression of some of the lower-rated names,” they said.

Heading into the fourth quarter of 2024, “there would be some additional uncertainty to the muni market outlook related to the presidential and the congressional election outcomes,” according to Barclays strategists.

Secondary trading

Wisconsin 5s of 2024 at 3.07% versus 3.27% on 11/21. Connecticut 4s of 2025 at 2.92% versus 2.95% original on Thursday. DASNY 5s of 2025 at 2.83%.

Maryland 5s of 2027 at 2.62%-2.61% versus 2.75%-2.74% Wednesday and 2.84% Tuesday. NYC 5s of 2028 at 2.67%. Triborough Bridge and Tunnel Authority 5s of 2029 at 2.58% versus 2.60%-2.58% Thursday.

California 5s of 2033 at 2.67%-2.66% versus 2.66% Thursday and 2.78% Wednesday. Louisiana 5s of 2034 at 2.73% versus 3.07% on 11/20 and 3.10% on 11/17. University of California 5s of 2035 at 2.66%-2.65%.

San Diego USD 5s of 2048 at 3.72% versus 3.73%-3.72% Thursday. NYC 5s of 2051 at 4.07%-4.06% versus 4.11%-4.10% Wednesday and 4.21%-4.20% Tuesday.

AAA scales

Refinitiv MMD’s scale was bumped up to two basis points: The one-year was at 3.00% (unch, no Dec. roll) and 2.83% (unch, -1bp Dec. roll) in two years. The five-year was at 2.57% (-2), the 10-year at 2.61% (-2) and the 30-year at 3.77% (unch) at 3 p.m.

The ICE AAA yield curve was bumped three to six basis points: 2.99% (-3) in 2024 and 2.83% (-4) in 2025. The five-year was at 2.56% (-5), the 10-year was at 2.65% (-6) and the 30-year was at 3.74% (-3) at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.93% (unch) in 2024 and 2.80% in 2025. The five-year was at 2.65%, the 10-year was at 2.72% and the 30-year yield was at 3.73%, according to a 3 p.m. read.

Bloomberg BVAL was bumped two to three basis points: 2.88% (-2) in 2024 and 2.80% (-3) in 2025. The five-year at 2.55% (-3), the 10-year at 2.64% (-2) and the 30-year at 3.68% (-3) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.556% (-16), the three-year was at 4.318% (-17), the five-year at 4.145% (-16), the 10-year at 4.214% (-15), the 20-year at 4.574% (-14) and the 30-year Treasury was yielding 4.403% (-13) near the close.

Primary to come

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $1.269 billion of tax-exempt future tax-secured subordinate bonds, consisting of $1.202 billion of Fiscal 2024 Series D, Subseries D-1, serials 2026-2042, and $67.065 million of Fiscal 2024 Series E, Subseries E-1, serials 2028-2040. Jefferies.

The Garland Independent School District, Texas, (Aaa//AAA/) is set to price Tuesday $773.520 million of PSF-insured unlimited tax school building bonds, Series 2023A, serials 2025-2043, term 2048. BOK Financial Securities.

Hawaii (Aa2/AA+/AA/) is set to price Wednesday $750 million of taxable GOs, Series 2023 GM. Morgan Stanley.

The Monroe County Industrial Development Corp., New York, (Aa3/AA-//) is set to price Tuesday $409.800 million of University of Rochester Project revenue bonds, consisting of $309.070 million of tax-exempts, Series 2023A, terms 2034, 2053, and $100.730 million of taxables, Series 2023B, term 2033. Barclays.

The Los Angeles Department of Water and Power (Aa2/AA-//AA/) is set to price Thursday $380.835 million of power system revenue refunding bonds, 2023 Series E, serials 2025, 2029-2045, term 2053. RBC Capital Markets.

The Arizona Industrial Development Authority (/A//) is set to price Tuesday for the Equitable School Revolving Fund $230 million of social Senior National Charter School Revolving Loan Fund revenue bonds, serials 2025-2043, terms 2048, 2053. Siebert Williams Shank & Co.

The Indianapolis Local Public Improvement Bond Bank (A1//A/) is set to price Thursday $215.765 million of Indianapolis Airport Authority Project bonds, consisting of $70.025 million of non-AMT bonds, Series 2023I-1, serials 2026-2043, terms 2048, 2053, and $145.740 million of AMT bonds, Series 2023I-2, serials 2025-2043, terms 2048, 2053. Ramirez & Co.

The Sarasota County School Board, Florida, (Aa2///) is set to price Tuesday $198.485 million of certificates of participation, Series 2023A, serials 2024-2037. BofA Securities.

San Diego County (Aa1/AA+/AA+/) is set to price Tuesday $166.145 million of green County Public Health Laboratory and Capital Improvements certificates of participation, Series 2023, serials 2027-2043, terms 2048, 2053. Barclays.

The New York State Housing Finance Agency (Aa2///) is set to price Tuesday $131.770 million of sustainability affordable housing revenue bonds, consisting of $59.195 million of 2023 Series E-1, serials 2024-2035, terms 2038, 2043, 2048, 2053, 2058, 2063, and $75.575 million of 2023 Series E-2, terms 2063, 2063. Barclays.

The Housing Authority of Dekalb County, Georgia, (/A+//) is set to price Thursday $100.985 million of Kensington Station Project affordable multifamily housing senior revenue bonds, Series 2023A. KeyBanc Capital Markets.

The Wisconsin Housing and Economic Development Authority is set to price Tuesday $100.415 million of non-AMT housing revenue bonds, consisting of $33.095 million of 2023 Series D, terms 2026, 2027, 2028, 2029, 2030, 2031, 2032, 2033, 2034, 2035, 2038, 2043, 2048, 2053, 2058, and $67.320 million of 2023 Series E, term 2054. Wells Fargo Bank.

Competitive

The Louisville/Jefferson County Metro Government, Kentucky, (Aa1//AAA/) is set to sell $140.545 million of GOs, Series 2023A, at 10:30 a.m. eastern Tuesday.

Chandler, Arizona, (Aaa/AAA/AAA/) is set to sell $71.955 million of excise tax revenue obligations, Series 2023, at noon Tuesday, and $117.415 million of GOs, Series 2023, at 11 a.m. Tuesday.

Chattanooga, Tennessee, (Aa1//AA+/) is set to sell $113.035 million of electric system revenue bonds, Series 2023, at 10 a.m. Tuesday.

The New York City Transitional Finance Authority is set to sell $135.025 million of future tax-secured subordinate bonds, consisting of $113.425 million tax-exempts, Fiscal 2024 Series D, Subseries D-2, and $21.600 million of taxables, Fiscal 2024 Series E, Subseries E-2, at 11:15 a.m. Wednesday.

Pennsylvania (Aa3/A+/AA/) is set to sell $772.775 million of GOs, First Refunding Series of 2023, Bid Group A, at 10 a.m. Wednesday; $331.250 million of GOs, First Series of 2023, Bid Group B, at 10:30 a.m. Wednesday; $331.250 million of GOs, First Series of 2023, Bid Group C, at 11 a.m. Wednesday; and $672.500 million of GOs, First Series of 2023, Bid Group D, at noon Wednesday.