Municipals were firmer Tuesday as U.S. Treasury yields fell slightly, following the release of the Federal Open Market Committee meeting minutes that said officials will remain cautious about future interest rate hikes. Equities ended down.

Muni triple-A yield curves were bumped two to six basis points Tuesday, depending on the curve, as municipals continued to exhibit strength.

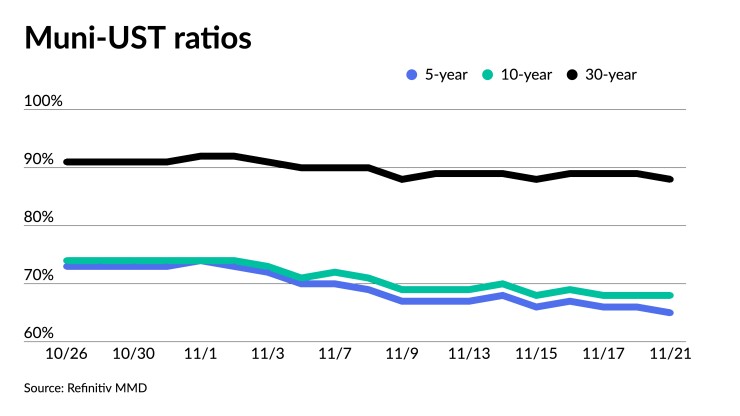

The two-year muni-to-Treasury ratio Tuesday was at 64%, the three-year at 65%, the five-year at 65%, the 10-year at 68% and the 30-year at 88%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 63%, the three-year at 64%, the five-year at 64%, the 10-year at 67% and the 30-year at 87% at 3:30 p.m.

The large drop in muni yields since the end of October can be reflected in the sentiment that investors expect a potentially dovish Fed next year, and that a “soft landing” narrative gives them “permission to finally purchase the bonds they’ve been admiring,” said Matt Fabian, a partner at Municipal Market Analytics.

Still, heavily traded par — the five-day rolling total of par traded has been more than $80 billion since mid-October — “continues to be driven almost totally by small lot size trades, many of which will involve increasingly last-ditch tax swaps by retail accounts,” he said.

With buyers having been so hesitant for so long, constructive retail involvement is currently enough to “support stronger prices and primary execution; this could be enough to set a favorable tone/headlines to cajole institutions back to buying as well,” he said.

For the mutual funds, “that would be a major change,” they said.

Fund flows year-to-date are approximating that of 2011, he said.

Only 2013 and 2022 “have been worse for cumulative fund flows since at least 2006,” Fabian said.

“Which means this would be an excellent time for inflows among the traditional mutual funds to begin: an idea the strong post [Oct. 31] trend in fund NAVs would seem to support,” he said.

Exchange-traded funds have seen eight weeks of inflows, the last three of which have been strong, “which may be actual long-term purchases or instead a more temporary position as tax swap landing place and/or tentative allocating by active mutual funds,” he said.

Still, banks are not showing renewed signs of buying, and while insurance company premiums have risen sharply year-to-date, “this does not necessarily mean the companies will be buying munis,” he said.

Munis “will need a change from at least one of the three groups, in particular the funds, for the recent rally to be sustained and extended into yearend; retail alone may not be enough,” he said.

The muni market outlook continues to improve, said Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals.

While supply is light this week due to the Thanksgiving holiday, they said “heavy supply should continue through the end of the year, and bond dealers are reluctant to hold oversized positions of municipal bonds.”

That being said, Persson and Close expect “increased demand with the outsized reinvestment money coming on Dec. 1 and Jan. 1, 2023.”

Secondary trading

Boston 5s of 3.18% versus 3.20% Monday. Ohio 5s of 224 at 3.30%. North Carolina 5s of 2025 at 3.13%-3.11% versus 3.16% on 11/15.

NYC TFA 5s of 2027 at 2.95%. Washington 5s of 2028 at 2.99% versus 3.00% Monday and 3.10%-3.05% original on 11/15. California 5s of 2029 at 2.99%-2.96% versus 3.01%-2.97% Monday and 3.09%-3.02% on 11/15.

California 5s of 2032 at 2.98% versus 3.00% Monday and 3.03%-3.02% Friday. NYC 5s of 2033 at 3.12%-3.11%. DC 5s of 2033 at 3.04% versus 3.14%-3.11% Friday and 3.29% original on 11/15.

San Diego USD 5s of 2048 at 4.07%-4.00% versus 4.19% original on Thursday. Massachusetts 5s of 2053 at 4.30%-4.31% versus 4.30% Monday and 4.33%-4.36% Friday.

AAA scales

Refinitiv MMD’s scale was bumped two to three basis points: The one-year was at 3.23% (-2) and 3.11% (-3) in two years. The five-year was at 2.89% (-3), the 10-year at 2.99% (-2) and the 30-year at 4.05% (-2) at 3 p.m.

The ICE AAA yield curve was bumped two to four basis points: 3.22% (-3) in 2024 and 3.10% (-3) in 2025. The five-year was at 2.89% (-3), the 10-year was at 2.98% (-3) and the 30-year was at 3.98% (-3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped three basis points: The one-year was at 3.21% (-3) in 2024 and 3.08% (-3) in 2025. The five-year was at 2.94% (-3), the 10-year was at 3.01% (-3) and the 30-year yield was at 4.02% (-3), according to a 3 p.m. read.

Bloomberg BVAL was bumped three to six basis points: 3.18% (-5) in 2024 and 3.11% (-6) in 2025. The five-year at 2.88% (-5), the 10-year at 2.97% (-5) and the 30-year at 4.00% (-3) at 3:30 p.m.

Treasuries were slightly firmer.

The two-year UST was yielding 4.881% (-2), the three-year was at 4.601% (-3), the five-year at 4.413% (-3), the 10-year at 4.409% (-1), the 20-year at 4.753% (-2) and the 30-year Treasury was yielding 4.570% (flat) at 3:45 p.m.

FOMC minutes

Officials determined they could be cautious about future interest rate hikes and take action only if incoming data suggested progress on reducing inflation was insufficient, according to minutes of the Oct. 31-Nov. 1 Federal Open Market Committee meeting, released Tuesday.

Participants agreed they could “proceed carefully and that policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks,” according to the minutes.

Rate hikes would be needed “if incoming information indicated that progress toward the Committee’s inflation objective was insufficient.”

With inflation “well above” the Fed’s 2% target, and despite significantly tighter financial conditions, the minutes noted, “participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2% objective over time.”

To hit its inflation target by the end of 2024, John Vail, chief global strategist at Nikko Asset Management, said, “the Fed will need to remain hawkish” and perhaps won’t cut rates.

“Markets are moderately more dovish than this scenario, so there will likely be some headwinds in 2024, but if corporate earnings and guidance can keep surprising to the upside, the stock market will likely be able to rise,” he said. “Higher duration fixed income markets will likely continue to be volatile in 2024, but in this scenario, their losses are mostly behind us.”

“The minutes were in line with expectations and recent Fed speak,” said Jay Hatfield, CEO at Infrastructure Capital Management. “They noted the increase in long-term rates tightened financial conditions but also reiterated that the tight labor market creates upside risks to inflation.”

While the hiking cycle is likely over, he said, the Fed “will continue to talk tough.”

In addition to focusing “on the failed Phillips Curve inflation theory,” Hatfield said, the Fed relies on “lagged/outdated measures of inflation” rather than “real-time data.”

But following the FOMC meeting, “economic indicators have donned a decidedly weakening-growth, ebbing-inflation tone and bond yields have backed down (by more than 45 bps at the 10-year tenor),” noted BMO Deputy Chief Economist Michael Gregory. “What will the Fed make of these developments heading into its next confab in three weeks? We scoured the minutes for clues; we didn’t find many.”

As for the decline in bond yields, the FOMC is “uncertain” if this tightening will be persistent, he said, “so, it seems this factor isn’t being given full weight in the Fed’s reaction function just yet. Besides, even after recent declines, bond yields remain elevated by recent historical standards.”

As for the minutes’ note that risks to the outlook are “more two-sided,” which means the Fed has to be more careful, Gregory said, “careful basically means that the bar to raise rates has been lifted, but there’s still a bar even if it’s now meaningfully higher.”