Volatility continues as municipals were slightly weaker in spots Wednesday but outperformed U.S. Treasuries, which saw the greatest losses out long. Equities ended down.

Munis were cut up to three basis points, depending on the scale, while UST yields rose up to as much as 14 basis points in 30 years.

The two-year muni-to-Treasury ratio Wednesday was at 71%, the three-year was at 71%, the five-year at 71%, the 10-year at 72% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 73%, the three-year at 74%, the five-year at 73%, the 10-year at 74% and the 30-year at 92% at 4 p.m.

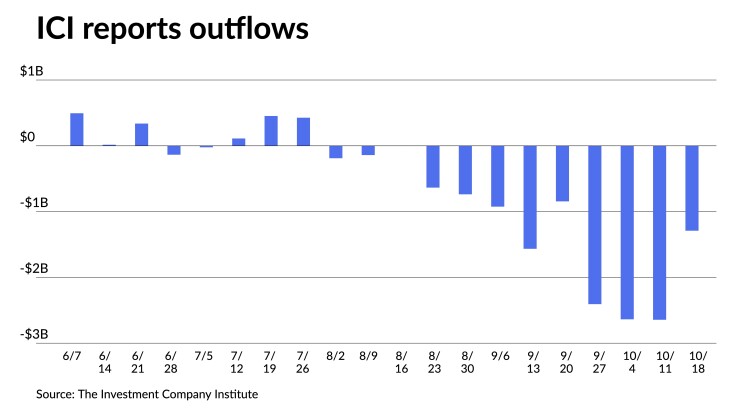

Municipal mutual fund losses continued last week — but to a lesser extent — as the Investment Company Institute Wednesday reported investors pulled $1.291 billion from the funds in the week ending Oct. 18 after $2.645 million of outflows the previous week.

Exchange-traded funds, though, saw another week of inflows to the tune of $532 million after inflows of $681 million the week prior, according to ICI.

It was another busy day in the primary market Wednesday, as Citigroup Global Markets priced and repriced for the New York Transportation Development Corp. (Baa3/BB+//) $877.865 million of AMT special facilities revenue bonds, Series 2023, for Delta Air Lines’ LaGuardia Airport Terminals C&D Redevelopment Project, with 6s of 4/2035 at 5.60% and 5.625s at 5.85%, callable 4/1/2031.

Wells Fargo Bank priced for the Virginia Small Business Financing Authority (Aaa///) $125 million of Pure Salmon Virginia Project environmental facilities revenue bonds, Series 2022, with 5s of 12/2052 with a mandatory tender of 11/15/2024 at par, callable 5/15/2024.

In the competitive market, Minnesota (/AA+//) sold $454.175 million of certificates of participation to Jefferies, with 5s of 11/2024 at 3.90%, 5s of 2028 at 3.61%, 5s of 2033 at 3.80%, 5s of 2038 at 4.35% and 5s of 2043 at 4.63%, callable 11/1/2033.

Nevada (Aa1/AAA/AA+/) sold $433.405 million of GO capital improvement bonds, Series 2023A, to J.P. Morgan with 5s of 5/2024 at 3.78%, 5s of 2028 at 3.58%, 5s of 2033 at 3.73%, 5s of 2038 at 4.29% and 5s of 2043 at 4.63%, callable 11/1/2033.

The state also sold $13.890 million of GO natural resources and open space bonds, Series 2023B, to J.P. Morgan with 5s of 5/2024 at 3.70%, 5s of 2028 at 3.58%, 5s of 2033 at 3.73%, 5s of 2038 at 4.29% and 5s of 2043 at 4.63%, callable 11/1/2033.

The state sold $29.505 million GO open space, parks and natural resources bonds, Series 2023C, to J.P. Morgan with 5s of 5/2024 at 3.70%, 5s of 2028 at 3.58%, 5s of 2033 at 3.73%, 5s of 2038 at 4.29% and 5s of 2043 at 4.63%, callable 11/1/2033 as well.

Additionally, the state sold $5.910 million of GO Safe Drinking Water Revolving Fund matching bonds, Series 2023D, to Hilltop Securities, with 5s of 8/2024 at 3.90%, 5s of 2028 at 3.70% and 5s of 2029 at 3.70%, noncall.

All about interest rates

All eyes will be on the November Federal Open Market Committee meeting next week. There is a very slim chance the Fed will hike rates by 25 basis points, but there is a chance the Fed may hike rates in December.

If the Fed raises rates, that will lower bond prices, said Eve Lando, portfolio manager and managing director of Thornburg Investment Management.

Since March 2022, the Fed has hiked rates 11 times, going from 25 basis points to 525 basis points.

The 10-year muni has risen from 1% to 3%, however, she noted “it hasn’t been ‘basis point for basis point’ for munis in how we followed the Treasury market.”

While muni yields widened by about 200 basis points, there has “been quite expensive compared to Treasuries on a ratio basis for some time.”

For instance, the two- to five-year muni-USTs ratios are below historical averages.

Dwindling supply, she said, is one reason for the richness of munis, she said.

New issuance is running around 21% lower year-to-date versus the same period in 2022, she said.

“The issuers hit the pause button, initially expecting the pivot, and now expecting inflation to subside and, perhaps, yields to decline,” she said.

Anecdotally, Lando noted, “some of the projects that were online pre-COVID have been repriced now and are roughly 30% more expensive.”

“So, for the issuers who paused because they thought the Fed would roll rates back and are now waiting to see if the Fed’s aggressive tightening will overpower inflation, that’s not happening yet.

While the decline in issuance is “startling,” Lando noted that “another surprising data point is that the overall size of the muni market hasn’t changed much in the past decade.”

The size of the muni market has remained at about $4 trillion from 2013 to 2023, she said.

In contrast, she said, “the taxable bond market expanded by 46% in 10 years, while mortgage-backed securities grew 39% during the same period.”

She said she’s not “arguing for abundant, some may say reckless, issuance by municipalities” but rather highlighting that supply “plays a role in how the tax-exempt market reacts through a rising-rate environment.”

And despite recent market volatility, the sector’s credit profile is still in relatively good shape, she said.

The sector itself is stable, she said.

With investments into essential service providers, school districts and state governments, she said “there should be less of an impact in a hard or soft landing than for other capital market borrowers.”

Municipal borrowers have “also done well building up their reserves, through prudent management for some, and plenty of COVID funds for other,” she said.

For most, reserves are twice as high as “compared to the 2008 period, just before the Great Recession,” she noted.

Additionally, she said, investors are getting paid.

Both on an absolute and relative basis, AAA-rated housing deals are seeing yields as high as 4.25% within 10 years, she said.

Credit spreads are widening as “investors are getting paid to add on sectors such as healthcare and pre-paid gas,” she said. “On a relative basis, when we compare ourselves to the corporate sector, munis look good, great even.”

Secondary trading

Maryland 5s of 2024 at 3.74% versus 3.70% on 10/16. DC 5s of 2024 at 3.84%. Washington 5s of 2025 at 3.80%-3.77% versus 3.87% Tuesday.

Massachusetts 5s of 2028 at 3.53%. Georgia 5s of 2028 at 3.52%-3.53% versus 3.54% Friday. Georgia 5s of 2029 at 3.52%.

Connecticut 5s of 2032 at 3.78% versus 3.80% Monday and 3.83% original on 10/19. DASNY 5s of 2033 at 3.57% versus 3.49% Tuesday. NYC 5s of 2034 at 4.00% versus 3.93% Tuesday and 3.91% on 10/18.

Washington 5s of 2048 at 4.80% versus 4.81%-4.80% on 10/19 and 4.59%-4.57% on 10/16. Massachusetts 5s of 2051 at 4.82%-4.83% versus 4.75%-4.76% original on 10/18.

AAA scales

Refinitiv MMD’s scale was cut up to two basis points: The one-year was at 3.76% (unch) and 3.65% (unch) in two years. The five-year was at 3.49% (unch), the 10-year at 3.59% (unch) and the 30-year at 4.55% (+2) at 3 p.m.

The ICE AAA yield curve was cut two basis points: 3.73% (+2) in 2024 and 3.70% (+2) in 2025. The five-year was at 3.53% (+2), the 10-year was at 3.57% (+2) and the 30-year was at 4.56% (+2) at 4 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 3.79% in 2024 and 3.69% in 2025. The five-year was at 3.54%, the 10-year was at 3.60% and the 30-year yield was at 4.54%, according to a 3 p.m. read.

Bloomberg BVAL was cut one to three basis points: 3.80% (+1) in 2024 and 3.74% (+1) in 2025. The five-year at 3.53% (+2), the 10-year at 3.63% (+3) and the 30-year at 4.59% (+3) at 4 p.m.

Treasuries sold off.

The two-year UST was yielding 5.124% (+1), the three-year was at 4.972% (+6), the five-year at 4.908% (+9), the 10-year at 4.943% (+12), the 20-year at 5.283% (+13) and the 30-year Treasury was yielding 5.075% (+14) near the close.

Primary to come

The Chicago Board of Education (/BB+/BB+/BBB/) is set to price Thursday $600 million of dedicated revenues unlimited tax GOs, Series 2023A. BofA Securities.

Cape Coral, Florida (/AA//), is set to price this week $138.085 of BAM-insured North 1 West Area utility improvement assessment refunding. Morgan Stanley.

The Illinois Finance Authority is set to price Thursday $100 million of LRS Holdings Project solid waste disposal revenue bonds, consisting of $30 million of green bonds, Series 2023A, and $70 million of bonds, Series 2023B. J.P. Morgan.

Competitive

The Virginia Public School Authority (Aaa/AAA/AAA/) is set to price $134.600 million of special obligation school financing bonds, Series 2023, at 10:30 a.m. Thursday.

The Albemarle County Economic Development Authority (Aa1/AA+/AA+/) is set to sell $109.650 million of public facilities revenue bonds, Series 2023A, at 11 a.m. Thursday, and $59.195 million of taxable public facilities revenue notes, Series 2023B, at 10:15 a.m.