Municipals took a breather Friday and were little changed ahead of a sizable new-issue calendar while underperforming a better U.S. Treasury market. Equities were in the red to close the session.

Triple-A yields barely budged while USTs saw yields fall nine to 11 basis points on bonds in the three- to seven-year maturities and smaller gains out long.

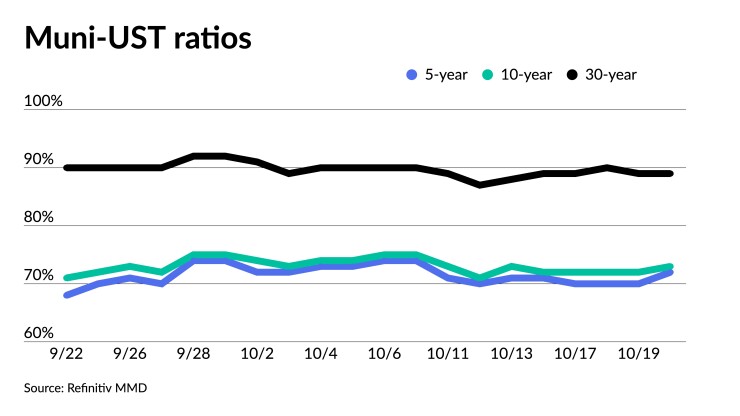

The two-year muni-to-Treasury ratio Friday was at 72%, the three-year was at 72%, the five-year at 72%, the 10-year at 73% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 72%, the three-year at 72%, the five-year at 71%, the 10-year at 72% and the 30-year at 89% at 4 p.m.

Despite the gains USTs made Friday, the losses throughout this week were substantial.

“On the back of strong economic data, which this week included robust retail sales, and a relative lull in the Middle East, U.S. Treasuries have sold off significantly, with yields rising 30-35bp across the curve,” according to Barclays PLC.

The 10-year UST “is trying to pierce the psychologically important 5% level,” said Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel.

Munis were in “lock-step” with USTs throughout the week, but slightly outperforming them in the selloff, they said.

“Similar to the calmness in the macro market, we see little stress or liquidity concern in muni market activity despite the continued selloff,” BofA strategists said.

The muni market “held up relatively well, just given the size of the calendar coupled with volatility within the broader market,” said Kara South, a portfolio manager at GW&K Investment Management.

The primary market took center stage this week, she said.

There were several billion-dollar deals, and the demand in general for these deals was pretty good, she said.

Primary market deals have been large in recent weeks, with new issuance month-to-date at $18.3 billion, 77% higher than the same time in 2022, BofA strategists noted.

“Secondary market activity and low dealer inventory levels also suggest that the market is normal,” they noted.

In the first week of October, there seemed to be “a large quantity of sell activity briefly, but after the geopolitical events in the Middle East, that activity looks quite muted,” they said.

Issuance will likely be active for the next two to three weeks, “with the 30-day visible supply for tax-exempt bonds reaching its highest level in more than a year,” Barclays strategists said.

The current muni selloff “has been quite orderly so far, as dealers preempted it, getting relatively light in early October,” they said.

“Although bid-wanted activity has been heavy enough, while secondary trading activity has also become robust, similar to what happened late last year, we think munis remain on a relatively solid footing,” Barclays strategists said.

Even after this week’s rise in yields, they said “fund flows were barely in the negative territory.”

Fund flows put “some pressure on the secondary market which is even harder in weeks like this, in which you have the focus being a primary market to get people’s attention on those bid lists and secondary trading,” South said.

October is not usually as strong of a month from a technical perspective, but she said the muni market held in relatively well this week.

Fundamentals within the muni market remain solid, “supported by the double-digit revenue growth that we saw in 2021 and 2022,” she said.

And “although we do see revenue declining going forward, the starting point for credit is really strong,” she said.

As the end of the year approaches, there may be a pick up in tax-loss harvesting requests, which can put additional pressure on the secondary market.

“We’ve already seen that happen a little bit, but a lot of people tend to do that at year-end,” South said. “So as we come into November, December time period, that could put some additional pressure on the market from a fund outflow perspective.”

New-issue calendar

The new-issue muni calendar is estimated at $8.522 billion next week with $6.075 billion of negotiated deals on tap and $2.446 billion on the competitive calendar, according to Ipreo and The Bond Buyer, while 30-day visible supply sits at $14.67 billion.

The New York Transportation Development Corp. leads the negotiated calendar with $881 million of special facilities revenue bonds, followed by $850 million of GOs from the Los Angeles Unified School District and $751 million of green transmission project revenue bonds from the New York Power Authority.

The competitive calendar is led by $483 million of GO debt from Nevada in four deals, followed by $450 million of certificates of participation from Minnesota.

Secondary trading

Georgia 5s of 2024 at 3.77%-3.75%. Tennessee 5s of 2024 at 3.80%. Massachusetts 5s of 2024 at 3.77%-3.75%.

California 5s of 2027 at 3.59% versus 3.62% Thursday. Connecticut 5s of 2028 at 3.67% versus 3.69% Thursday. NYC TFA 5s of 2029 at 3.69% versus 3.50% on 10/13.

Washington 5s of 2032 at 3.75%-3.70%. Massachusetts 5s of 2033 at 3.64%. Triborough Bridge and Tunnel Authority 5s of 2034 at 3.93% versus 3.88% Wednesday and 3.90%-3.89% Tuesday.

Triborough Bridge and Tunnel Authority 5s of 2047 at 4.96%. NYC 5s of 2048 at 5.05%-5.03% versus 4.64% on 10/10.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.78% and 3.67% in two years. The five-year was at 3.49%, the 10-year at 3.59% and the 30-year at 4.53% at 3 p.m.

The ICE AAA yield curve was bumped up to a basis point: 3.73% (unch) in 2024 and 3.71% (unch) in 2025. The five-year was at 3.53% (unch), the 10-year was at 3.57% (-1) and the 30-year was at 4.55% (-1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.81% in 2024 and 3.71% in 2025. The five-year was at 3.54%, the 10-year was at 3.60% and the 30-year yield was at 4.54%, according to a 3 p.m. read.

Bloomberg BVAL was little changed: 3.81% (unch) in 2024 and 3.75% (unch) in 2025. The five-year at 3.52% (unch), the 10-year at 3.62% (unch) and the 30-year at 4.57% (unch) at 4 p.m.

Treasuries were better across the curve.

The two-year UST was yielding 5.085% (-7), the three-year was at 4.926% (-9), the five-year at 4.861% (-9), the 10-year at 4.917% (-6), the 20-year at 5.291% (-4) and the 30-year Treasury was yielding 5.082% (-2) near the close.

Primary to come

The New York Transportation Development Corp. (Baa3/BB+//) is set to price Wednesday $881.225 million of special facilities revenue bonds, Series 2023, for Delta Air Line’s LaGuardia Airport Terminals C&D Redevelopment Project, terms 2035, 2040. Citigroup Global Markets.

The Los Angeles Unified School District (Aa3//AAA/AAA/) is set to price Tuesday $850 million of GO sustainability decided unlimited ad valorem property tax bonds, Series QRR (2023), consisting of $815.435 million of Series 1 and $34.565 million of Series 2. Morgan Stanley.

The New York Power Authority (A1/AA//) is set to price Tuesday $750.975 million of Assured Guaranty-insured Green Transmission Project revenue bonds, Series 2023A. Goldman Sachs.

Chicago is set to price Tuesday $519.750 million of senior lien airport revenue and revenue refunding bonds on behalf of the Chicago Midway Airport, consisting of $219.425 million of AMT bonds, Series 2023A, and $300.325 million of non-AMT bonds, Series 2023B. Jefferies.

The Pennsylvania Housing Finance Agency (Aa1/AA+//) is set to price Tuesday $408.315 million of single-family mortgage revenue bonds, consisting of $388.080 million of non-AMT social bonds, Series 2023-143A, serials 2034-2035, terms 2038, 2043, 2048, 2051 and 2053; and $20.235 million of taxables, Series 2023-143B, terms 2038 and 2043. Wells Fargo Bank.

The Phoenix Civic Improvement Corp. (Aa2/AAA//) is set to price Tuesday $396.960 million of junior lien wastewater system revenue bonds, Series 2023, serials 2028-2047. Jefferies.

Freddie Mac (/AA+//) is set to price Wednesday $364.010 million of sustainability structured pass-through certificates, consisting of $182.005 million of Series ML-18, Class A, serial 2037; and $182.005 million of Series ML-18, Class X, serial 2037. Citigroup Global Markets.

The Fishers Town Hall Building Corp. (/AA//) is set to price Tuesday $170 million of lease rental revenue bonds, consisting of $160 million of tax-exempts, Series 2023A, serials 2026-2031, terms 2032-2043, 2048, 2053, 2058 and 2063; and $10 million of taxables, Series 2023B, serial 2026, terms 2027-2034. Raymond James & Associates.

Rhode Island (Aa2/AA/AA/) is set to price Tuesday $146.705 million of GO consolidated capital development loan of 2023 bonds, consisting of $122.405 million of tax-exempts, Series A, serials 2029-2043, and $24.300 million of taxables, Series B, serials 2024-2028. BofA Securities.

Cape Coral, Florida (/AA//), is set to price next week $138.085 of BAM-insured North 1 West Area utility improvement assessment refunding. Morgan Stanley.

The New York City Housing Development Corp. (Aa2/AA+//) is set to price Tuesday $125 million of taxable sustainable development index floating rate multi-family housing revenue bonds, 2023 Series C, term 2063. Loop Capital Markets.

The Virginia Small Business Financing Authority (Aaa///) is set to price Wednesday $125 million of Pure Salmon Virginia Project environmental facilities revenue bonds, Series 2022, serial 2052. Wells Fargo Bank.

The Illinois Finance Authority is set to price Thursday $100 million of LRS Holdings Project solid waste disposal revenue bonds, consisting of $30 million of green bonds, Series 2023A, and $70 million of bonds, Series 2023B. J.P. Morgan.

Competitive

Fayetteville, North Carolina (Aa2/AA/AA/), is set to sell $171.105 million of Public Works Commission revenue bonds, Series 2023, at 11 a.m. eastern Tuesday.

The California Public Works Board is set to sell $299.820 million of lease revenue bonds, 2023 Series D, at 11:30 a.m. Wednesday and $55.275 million of lease revenue bonds, 2023 Series E, at 11 a.m. Wednesday.

Minnesota (/AA+//) is set to sell $449.935 million of certificates of participation, Series 2023, at 11:15 a.m. Wednesday and $26.030 million of taxable State General Fund appropriation bonds, Series 2023A, at 11:30 a.m. Wednesday, and

Nevada (Aa1/AAA/AA+/) is set to sell $433.725 million of GO capital improvement bonds, Series 2023A, at 10:45 a.m. Wednesday; $29.415 million GO open space, parks and natural resources bonds, Series 2023C, at 11:30 a.m. Wednesday; $13.865 million of GO natural resources and open space bonds, Series 2023B, at 11:30 a.m. Wednesday; and $5.895 million of GO Safe Drinking Water Revolving Fund matching bonds, Series 2023D, at 10:45 a.m. Wednesday.

The Virginia Public School Authority (Aaa/AAA/AAA/) is set to price $134.600 million of special obligation school financing bonds, Series 2023, at 10:30 a.m. Thursday.

Christine Albano contributed to this story.